Mastering Essential Excel Formulas for Financial Analysis

Chosen theme: Essential Excel Formulas for Financial Analysis. Step into a practical, story-driven guide to the formulas that power budgets, forecasts, valuations, and dashboards—built for analysts who want clarity, confidence, and speed.

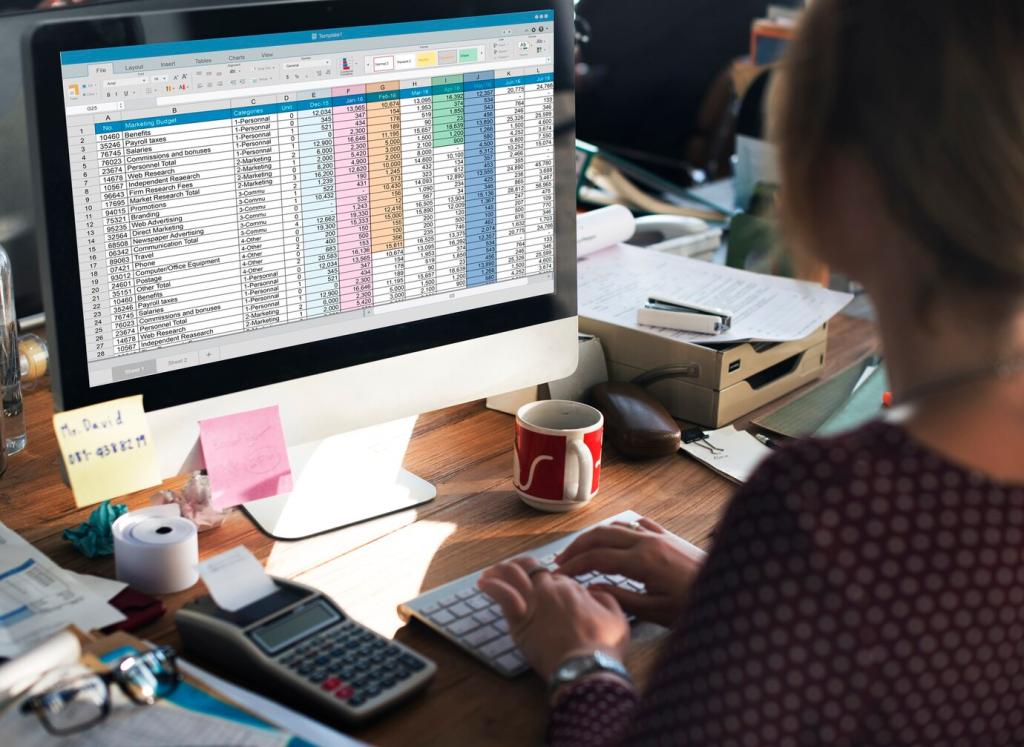

Chart of Accounts Rollups with SUM and SUMIFS

Group accounts by department, region, or product using structured references and SUMIFS. A tidy mapping table lets one formula scale across the entire model, reducing errors and simplifying monthly closes.

Seasonality Smoothing Using AVERAGE and AVERAGEIFS

Average trailing periods by channel to calm seasonal spikes before forecasting. AVERAGEIFS helps isolate comparable months so your baseline reflects typical demand, not a one-off promotion or stock-out.

Outlier Spotting with MIN and MAX Checks

Create guardrail cells that compare current values to historical MIN and MAX. If metrics break outside bands, flag them boldly to investigate posting errors, missing transactions, or extraordinary operational events.

Time Value of Money in Excel: NPV, XNPV, IRR, and XIRR

Tie your discount rate to weighted average cost of capital or a project-specific hurdle. Sensitize outcomes with a small rate table, then use XNPV to incorporate exact cash flow dates with realistic timing.

This is the heading

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

This is the heading

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Conditional Logic and Clean Errors: IF, IFS, SWITCH, IFERROR

Build pricing tiers, loan rates, or bonus plans using IFS to capture clear thresholds. Keep logic centralized in an Assumptions sheet so a single tweak transparently updates forecasts across the workbook.

Multi-Criteria Aggregation: SUMIFS, COUNTIFS, AVERAGEIFS

Revenue by Channel with SUMIFS

Roll revenue by channel, region, and customer segment using SUMIFS with structured references. This ties naturally to dashboards where slicers or dropdowns let executives self-serve the view they need.

Aligning Periods with EOMONTH and EDATE

Wrap schedules around EOMONTH to anchor monthly statements and deferred revenue. When contracts begin off-cycle, EDATE advances timing cleanly, avoiding manual edits and end-of-month reconciliation scrambles.

Interest Accrual Using YEARFRAC

Compute prorated interest with YEARFRAC to respect day-count conventions. This aligns investor updates, covenant tracking, and earnings bridges, especially when loans transition mid-quarter or restructure mid-year.

Cash Conversion Cycle with NETWORKDAYS

Measure days payable and receivable using NETWORKDAYS or WORKDAY.INTL to exclude weekends and local holidays. The insight reveals where process tweaks can unlock cash without cutting necessary expenses.